Maximize Your Feb 2025 Year End Tax Savings with MCM’s Finance Deal!!

Farmers across South Africa, are you ready to capitalize on a powerful tax-saving opportunity while upgrading your machinery fleet? At MCM, we’re offering an exclusive deal that combines an unbeatable payment plan and significant SARS tax benefits under the 50:30:20 tax wear & tear allowance scheme.

Act now! By paying a deposit on a machine before the end of February 2025, you can take delivery of your equipment and settle the remaining balance on an approved Finance Deal (subject to finance approval). Let’s break down how you can benefit from this and SARS’s generous tax allowances.

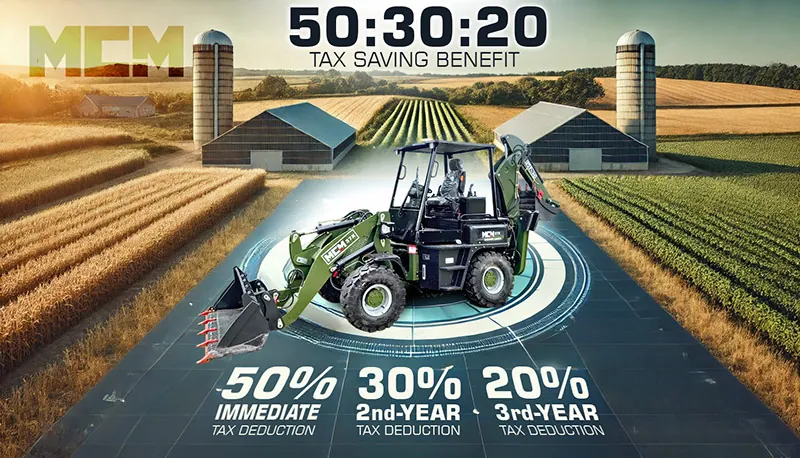

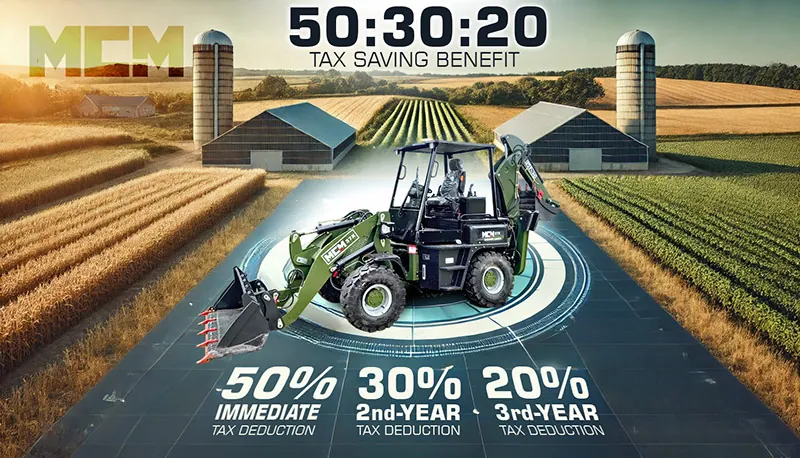

Understanding the 50:30:20 Wear & Tear Tax Allowance Scheme from SARS

The 50:30:20 wear & tear allowance from SARS allows qualifying taxpayers to write off the cost of new machinery over three years as follows:

- 50% Immediate Deduction: Claim 50% of the purchase price in the first tax year.

- 30% in Year Two: Claim an additional 30% of the cost in the second year.

- 20% in Year Three: Deduct the remaining 20% in the third year.

This tax incentive is specifically designed to encourage businesses, particularly in agriculture, to invest in machinery that boosts productivity while reducing tax liability.

For example, if you purchase a wheel loader worth R1,000,000:

- Year 1: Deduct R500,000 from the Purchase Price and reduce your Tax Income.

- Year 2: Deduct R300,000

- Year 3: Deduct R200,000

This adds up to significant cash flow benefits, making your investment highly affordable and with only paying now a deposit get the full tax and usage advantage before year end.

Read more about SARS Wear & Tear tax allowances here.

Here is a full document detailing a Complete Guide to Farming Taxation: Click Here to Open

Why This Deal Makes Sense

- Maximize Your Tax Savings & Cashflow:

Take advantage of the 50:30:20 scheme with MCM’s exclusive offer on new machinery purchases. This allows you to optimize your cashflow with a lower tax burden, benefit from a VAT refund, and secure your machinery by paying only the deposit before the end of February 2025. - Flexible Payment Terms: Pay only a deposit before end of February 2025 upfront and spread the balance as per approved finance deal.

- Immediate Operational Gains: Start using your new machine to maximize your farm’s productivity without waiting for full payment.

Popular Machines For Sale Eligible for the Offer (Only 4 Examples – Much more on the Website)

- Everun ER2500 Wheel Loader for Sale

Compact, powerful, and designed for versatile farm use.

Click for an instant quote. - Telescopic Loader T250 for Sale

Perfect for reaching high silos or handling bulky loads.

Get your instant quote today. - MCM 22D Excavator for Sale

Ideal for digging, land preparation, and trenching.

Request a personalized quote now. - MCM 37X Compact TLB for Sale

You need a compact Backhoe Loader you can count on.

Get personalized quote now.

How to Claim Your Deal

- Visit the MCM website to browse our wide range of machines.

- Use the Instant Quote feature to get a personalized price on your desired equipment.

- Contact MCM and mention the 50:30:20 Deposit Deal to ensure you’re eligible for this offer.

- Purchase your MCM equipment and work with your accountant to claim the SARS tax allowance benefits.

- Work with Your Accountant: Claim your VAT refund and tax allowance benefits.

Don’t Miss Out!

This is your chance to invest in top-of-the-line agricultural machinery while optimizing your tax savings. Explore MCM’s products online or reach out to our team today to get started. Let us help you grow your farm’s potential while keeping costs low.

Deadline: 28 February 2025

Take advantage of the deposit finance plan and SARS tax allowances now. Don’t wait—every day without the right equipment is a missed opportunity.

Here is an informative article written by Pietman Botha on Grain SA: Click Here to Open